The majority of the population have become more environmentally aware. Aside from recycling and doing our small part daily to help the environment, we have now learned that our money can do some good as well. One way to do that is to invest with an eco-friendly bank.

An eco-friendly bank sounds great on paper, and in reality it can be very beneficial, but there is something called “greenwashing”, which is similar to false advertising by a bank. A bank that practices greenwashing is one that states their practices are green, but in actuality offer little to no benefits to aid the environment.

How do you avoid greenwashing and make sure your money is really going to sustainable practices? The first step is to identify what constitutes an eco-friendly bank.

What is an Eco-Friendly Bank?

What exactly is an eco-friendly bank? In short, it’s a bank that is transparent in its practices, only funds and lends money to stop climate change, and adopts environmentally-friendly measures such as going paperless. Let’s take a closer look at how a bank can be considered sustainable.

How can a bank be ‘green’?

First of all, a green bank will not misrepresent their actions to be good for the environment when it isn’t. A green bank may also choose to go paperless. This means the digitization of notices, bills, and all mail in an attempt to limit paper waste. Some institutions may even go for energy-efficient light bulbs and ask employees to turn off all devices after work hours. The types of funds eco-friendly banks support do not dabble in industries that are involved in fossil fuels, factory farming, fast fashion, and anything else that can harm the earth and accelerate climate change. A good way to identify sustainable funds is by looking to ESG funds. To be considered a provider of ESG funds, the company’s practices are evaluated under a microscope.

ESG Criteria (environmental, social, corporate governance)

Environmental Factor

As the name suggests, the impact of a company on the environment makes up the environmental factor of the ESG criteria. This section entails how a company handles its waste, the amount of pollution it emits, and animal testing among other things. How closely does the company adhere to government regulations?

Social Factor

Does the company employ and value people of different ethnicities and genders? It’s not only the company, but do they also filter who they work with in terms of partners and suppliers and make sure they hold true to these values as well? What the company does on a social platform for its community and globally is also part of the social aspect. Donations to non-profits and engaging in volunteer work are all taken into consideration. In order to pass this part of the ESG criteria, a company needs to value the physical and mental health of its workers.

Governance Aspect

The governance aspect is how a company is managed. Shady practices should not and will not be tolerated. A company should be completely transparent in its operations in every department. Everything should be fair. It goes without saying that not pushing a political agenda, fair voting and taking all shareholders’ opinions into account are crucial.

It’s important to note that not all companies will pass all three criteria. If they do, then that’s great, but it’s still important for investors to do some due diligence before entrusting their money to certain funds. Another vital consideration is just because a company or organization hasn’t passed every aspect, it doesn’t mean they won’t in the future or they aren’t doing their part to ensure a cleaner future in the meantime.

What ESG companies Invest in Instead

We know the industries that eco-friendly banks do not engage in, but what do they invest in? One big example is clean energy. Hydro, wind and solar power are three very big ones. Other examples may include the following:

- EV financing

- Clean energy projects

- Reversing climate change

- Planting trees

- Animal welfare

- Environmental conservation

- A lot of green banks work with non-profits that share their values to further promote eco-friendly practices.

- Doing your part to make sure the bank or banking institution of your choice is really pursuing sustainable practices can take a lot of time. We have some true green institutions below to save you some time. These banking services do good with your money, and some of them even offer very favorable returns.

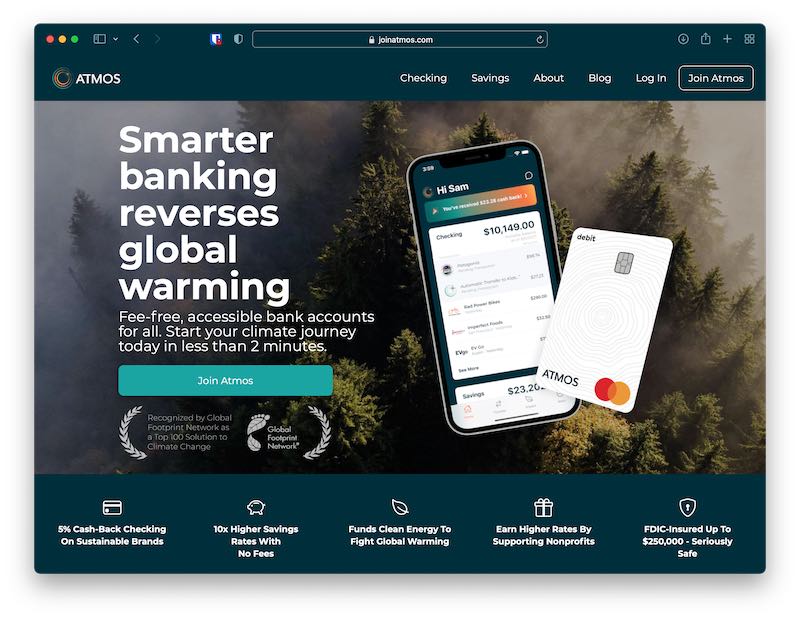

Our Top Pick: Atmos Financial

Sign up for a free Atmos account.

Sign up now

Our first and top suggestion is Atmos Financial. They are still relatively new to the scene, but they have made great strides in the name of eco-friendly banking. They have recently introduced their green debit card, that can offer users up to 5% cashback on select sustainable products, services and brands. Up to $250,000 of your money is FDIC insured, so your hard-earned money is seriously kept safe. Atmos’ primary goal and vision is to help the environment. Their mission is to transition to a completely clean economy one step at a time, with the end goal of permanent and positive change.

What Makes Them Different

What exactly does Atmos offer? Aside from the green debit card that also gives you free ATM withdrawals at over 55.000 All-Point ATMS, Atmos doesn’t collect any fees or implement any minimum requirements.

They also give users nationally leading rates of return for savings accounts - up to 0.51%. You can also open multiple savings accounts (up to 6), to help you budget for your future. Your money will be utilized for good, in a collective effort to reverse climate change. Atmos is entirely transparent with your money’s carbon footprint and works with non-profits that share the same vision and values. You can set up your Atmos account quickly - in just under 2 minutes! You can get started quickly and easily with no minimum and no fees. Atmos will also introduce joint bank accounts and as of now, you are able to link up to 3 external accounts.

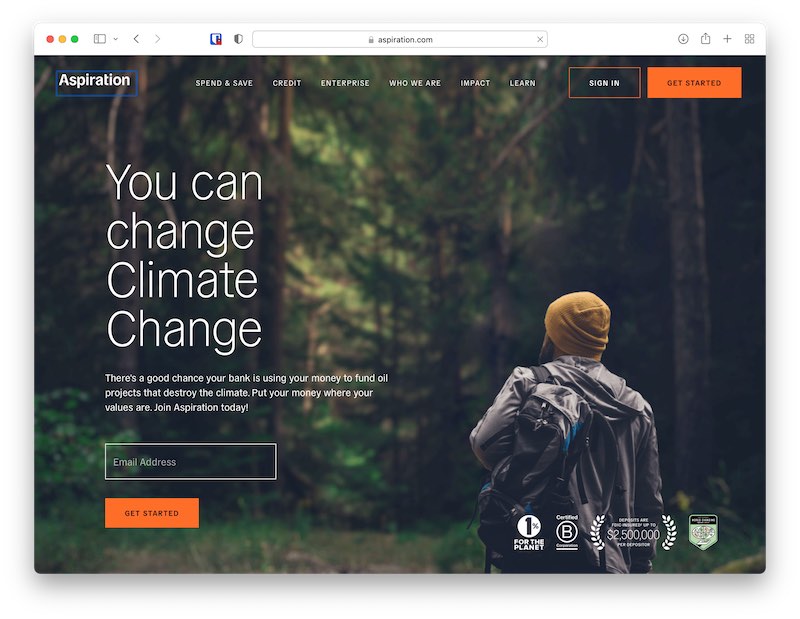

Aspiration Review

Sign up for a free Aspiration account.

Sign up now

Aspiration is another banking institution that focuses on climate change. Aspiration aims to bring financial benefits to everyone who is involved. Customers are top priority and they can spend, save and invest with peace of mind that their capital will only fund sustainable projects. Aspiration makes a very passionate pledge to their customers that pledges 10% of every dollar to charities that help improve the quality of life of many Americans. Aspiration offers something to individuals and businesses alike.

What Makes Them Different

For businesses, Aspiration assesses your carbon footprint and gives a clear overview of how your organization can become climate positive. You can take part in the platform’s nature-based carbon removal initiative to help with reforestation efforts. With tailored sustainability programs, Aspiration will work with businesses to eventually become environmentally friendly on a fundamental level. You will be able to involve and inspire your customers and employees to do the same. For the everyday user, Aspiration encourages you to spend sustainably by offering up to 83x higher interest on savings and a promise to only support eco-friendly industries and projects. Your money is encrypted and FDIC insured up to 2.5 million. One of the key traits of Aspiration is its users pay fees they think is fair - even if it’s 0. Aspiration will only charge the cost of service for each additional service and not a penny more.

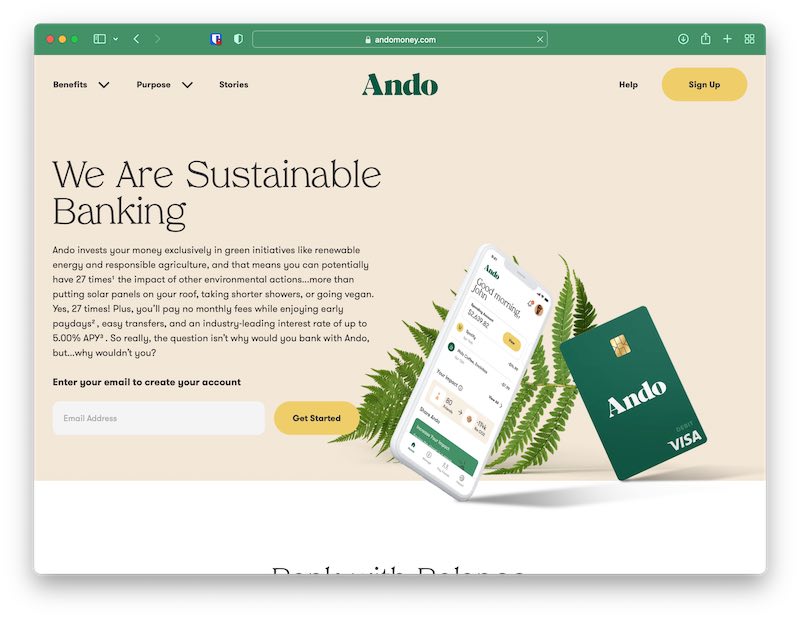

Ando Money Review

Sign up for a free Ando account.

Sign up now

Lastly, we have Ando Money, a fee-free digital banking service. Ando Money aims to be a force for good with value-based investments, green practices, and transparency all in an effort to solve climate change. Ando actively seeks and invests in funds that promote sustainability. With Ando, you can clearly see where your money is going. Follow the trail through their app and become a positive influence for a cleaner and better tomorrow. Ando helps draw a picture of your carbon footprint and how to effectively participate in carbon reduction.

What Makes Them Different

The mobile banking app is by far one of the best and most convenient features of banking with this platform. You can easily manage your funds and get insight into your money wherever you go. There are no fees required when transferring funds to between Ando accounts, so you can pay friends and family without the additional costs. Payday can also come early with Ando, and you can pick up your check 2 days earlier. Banking services are available 24/7 with Ando and you can earn even more with the more money you save without the extra fees. Ando is always 100% clear with the fees, but they are always fee-free.

Final Thoughts

Green banking is the way of the future, so we recommend choosing an eco-friendly bank sooner than later. These sustainable banking institutions usually offer higher rates of return and will definitely put your money towards good causes in the hopes to repair and improve the environment. Permanent change is the goal, and with the help of hundreds of thousands and hopefully millions of users, a cleaner future is within our grasp.