The Ford Mustang Mach E, the storied Mustang is now in an SUV form with a sleek new exterior and powered by electricity. The coveted new vehicle comes in different tiers with various battery sizes and four-wheel or just rear-wheel drives. On a single charge, Ford’s new EV can deliver up to 305 miles with 480 HP. For a transportation tool such as this one, you can’t help but put the pedal to the metal.

Smooth driving down the highway or ripping the asphalt on mountain roads, you need to insure your new wheels with gold-plated insurance. EV insurance is different than regular vehicles and we will explore why and suggest a couple of excellent providers.

But first, a quick review of the Ford Mach E if you’re not familiar:

Why is EV Insurance Different?

EV insurance is typically more expensive than regular coverage, but why is that? The short answer is because the components in EVs are more expensive. However, keep in mind that the difference you pay for the premium could even out if your EV qualifies for discounts.

The more expensive the parts are to replace, the higher the monthly payments. It’s also worth it to note that repairs aren’t the only factor that influences the higher price point. The driver’s driving habits, age, and even location can impact the cost.

For example, if you are a good driver who limits your travel during the daytime and are not a senior, chances are your coverage will cost less than someone who is more reckless and older.

Insurance is not cheap, and drivers are all doing the best they can to find the balance between coverage and costs. There are full-coverage options available that averages around $1000 USD, but there are also separate options that only cover medical, liability, or collision.

Another thing to be aware of is not a lot of autobody shops are equipped to deal with EVs, making it time consuming to fix. Although they have been around for quite some time, an electric vehicle is still considered a novel product. Therefore, finding a repair shop capable of fixing a damaged EV is difficult, which could also hike up the costs.

Even the type of EV you drive and the brand can affect the insurance costs. It may take time to inquire about the plans offered by different insurance companies, but we have narrowed down 2 of the best providers out there to save you some time.

Best Ford Mustang Mach E Insurance

-

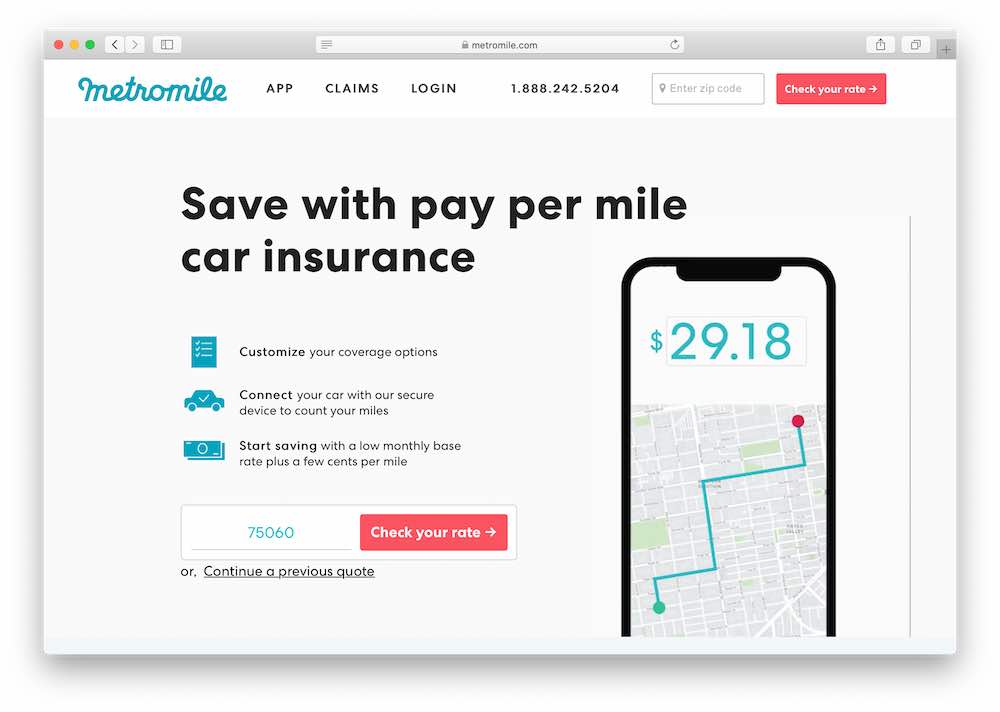

MetroMile

Our first consideration is MetroMile. An almost nationwide insurance company that offers a pay-per-mile option. Your insurance coverage will be based on how much you drive, so you will not be charged when you don’t drive.

MetroMile goes the extra mile (ahem) to tailor insurance plans to you personally. They analyze your driving habits to determine the rates, resulting in a 47% less cost than other companies. In numbers, that means the average driver saves about $741 annually.

What’s more, MetroMile offers free coverage over 250 miles daily (150 in New Jersey). This means even more money saved. You can choose between collision coverage, comprehensive insurance and more. MetroMile offers more than that by also giving drivers roadside assistance, 24/7 claims support and more.

It won’t matter how much an insurance provider offers if the claims are confusing. If you get into an accident, you can file your claim with MetroMile in just a few minutes. Everything can be done online and customer support will walk you through each step.

The MetroMile app allows you to take control of your trips. The app updates you in real-time of any traffic alerts or checks in certain cities and update you on the condition of your vehicle.

Don’t take our word for it, you can get started by trying the Ride Along. The Ride Along option lets you drive with MetroMile for 17 days. During this time, they will assess your habits and tendencies to determine your best rate.

Pros

- Widely available

- Has a downloadable app

- Pay-per-mile option available

- Different coverage options

- Ride Along option to determine your rate

- 24/7 customer support

- Easy claims

- Every mile over 250 (150 in New Jersey) is free

- Big savings

Why We Like it

Instead of looking at data on paper, MetroMile gets personal and caters to each driver’s habits on the road. This incentivizes better driving and allows good drivers to save more.

-

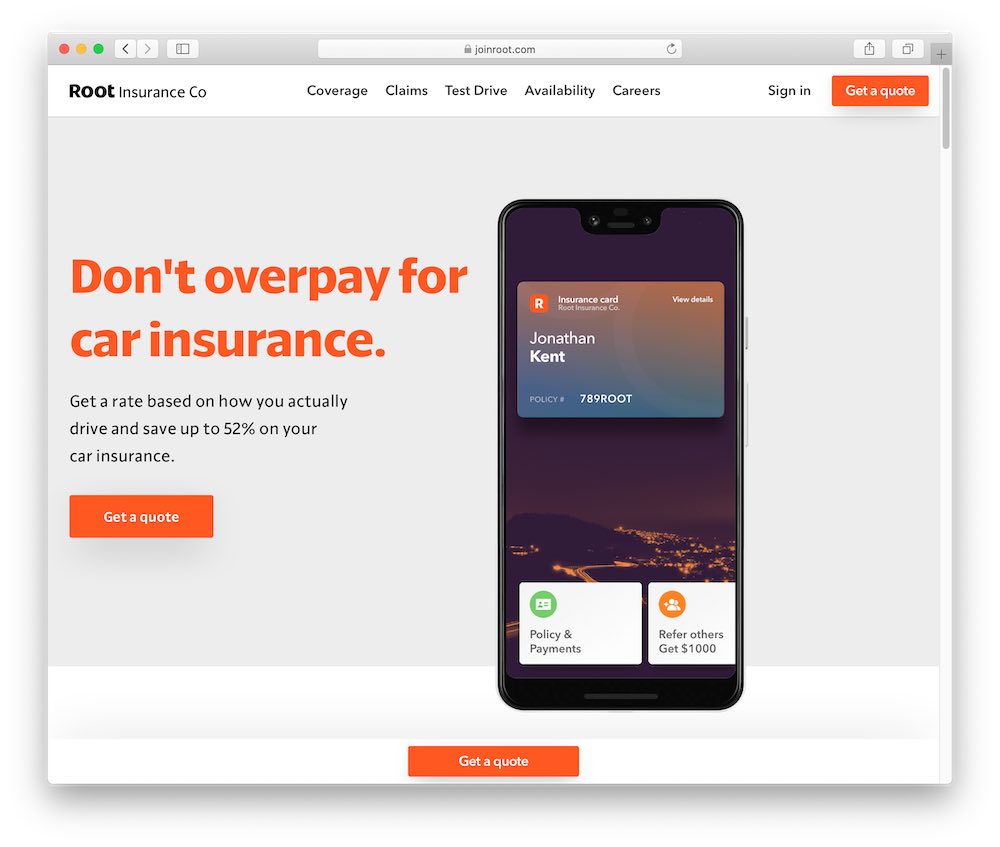

Root Insurance

Root Insurance is another coverage provider that prizes fairness when determining insurance rates. Featured on The Wall Street Journal, Forbes, CNBC, TechCrunch and more, Root’s reputation precedes them.

Root Insurance is where good drivers go to save money. Their app can be downloaded to your phone and from there it gathers data from your smartphone sensors to give you the best quote depending on how you drive.

Root takes into account how focused you are on the road, your breaking and turning and even when you drive to estimate your rates.

The yearly savings Root can offer its clients can reach $900! You can save more money with cash offers by referring friends and family and enjoy bonus perks from Root including free Lyft credits on certain holidays and roadside support.

Everything is viewable and easily manageable within the Root app, including filing a claim in under 3 minutes! All it takes is inputting the type of claim you wish to file, taking a picture of the damage, and their support team will take care of the rest.

Root Insurance is widely available in the states and will soon become accessible nationwide. You can pick from liability coverage, car coverage, medical coverage or all of the above with the full coverage option. Aside from car insurance, Root also offers renter and homeowner insurance packages.

One of the best parts about Root is their honesty and their value of putting customers first. If you find a cheaper rate with another provider, Root will not stand in your way of saving more money.

Pros

- Comprehensive Root app

- Different coverages

- Excellent customer service

- Widely available and soon to be nationwide

- Easy claim filing

- Extra perks such as cash rewards

- Lyft credits on certain holidays

- Roadside assistance

- Highly recognized provider

- Assigns rates based on driving

- Allows drivers to save up to $900 a year

Why We Like It

Customer service is the backbone of any company, and Root takes it to the next level. They put their existing and potential clients first with excellent and responsive customer support.

Tips to Lower Insurance Premiums for EVs

Good driving can help lower your rates, but is there anything else a driver can do to save costs?

Shopping around is one way to do it. You can compare different coverages offered by several providers to determine which is the best option for you. Think about the type of coverage you want. It may not always make sense to opt for full coverage. Read the contract carefully for different plans to determine which is best for your needs.

Aside from that, we also suggest paying your premium in one go instead of monthly installments.

If you do not yet own an EV, you can do some research online to find out which models are cheaper to insure. For example, the Fiat 500e and Nissan Leaf are among the most cost-efficient, while some Teslas are on the opposite end of the scale.

If you would like to improve your driving habits to lower your rates, you can consider taking a defensive driving course, which teaches you how to drive on the road to avoid accidents. Just make sure the course is accredited and is valid to reduce points on your license.

Another way is to increase your deductibles, which will lower the premium. However, this may not always be the best option depending on the numbers, so some math is required.

Installing preventative and safety devices in your car can also help lower the premium. For example, dash cams, anti-theft devices and car alarms are good options to consider.

Moving to a different state to save on insurance premiums is ludicrous, and there isn’t much you can do about where you live, but your location can influence the rates as well. But if you are coincidentally moving across state lines, the drop or rise in car insurance premiums is something you will want to keep in mind.

Lastly, consider pay-per-mile programs so you won’t be paying for miles you never drive and look into extra bonuses and incentives offered by providers that can save you even more money.

Conclusion

If shopping around for car insurance does not sound like a fun way to spend an afternoon, you can always try one of our suggested providers. They both offer trial drives to select the best rate for you. Investing in a monster EV like the Ford Mustang Mach E is only worth it with the right coverage. EVs can be more expensive to insure because the repairs are costly, but with the right insurance provider will have you covered.