With a name like Bolt, consumers expect the revamped fully electric vehicle from General Motors to reach high speeds. However, Bolt takes trailblazing to a whole new level by also elevating driver comfort. With a larger and roomier cabin plus cruise control to make sharp bends in the road easier to clear.

The Bolt EUV is also equipped with one of Chevrolet’s newest innovations - the Super Cruise. This feature allows for hands-free driving on certain roads. The Bolt EV can give you sufficient range at around 250 miles per full charge, so cruising comfortably down open roads in an affordable EV at no harm to the environment is no longer a distant dream.

Your new electric vehicle will do its job at protecting you and the environment, so the best we can do is return the favor with top tier insurance.

A quick review of the car below before we get started:

Why is EV Insurance Different?

There are a few reasons why EV insurance is more costly compared to regular gas guzzling models. One of the most glaring differences is the repair costs. To put it simply, the components in an EV are much more expensive than their fueled counterparts. Also, each part of an EV is required to carry out multiple tasks, which means the replacement is more extensive if an EV sustains damage. All of these factors can hike up insurance premiums.

Once you also take into consideration that not many autobody shops have the know-how to restore and repair EVs, the reason for the higher insurance coverage is even more obvious.

One of the most vital components in your electric vehicle is responsible for the detrimental costs of insurance, and that is the battery. The batteries in EVs, regardless of the model can be very costly to fix and replace.

It’s not all bad news though, as EVs are eligible for tax credits in certain parts of the country. Therefore, the extra money you spend on insurance can be offset by these breaks. There are also actions you can take to help minimize the costs, but we’ll cover that in a bit.

Best Bolt EUV Insurance

Identifying the best insurance for your Bolt EUV can be a time-consuming activity. Let’s be honest, spending a couple of hours or more on the phone with insurance providers is probably not something you want to spend your free time doing. Luckily, we have done the legwork and come up with 2 of the best companies to insure your Bolt EUV.

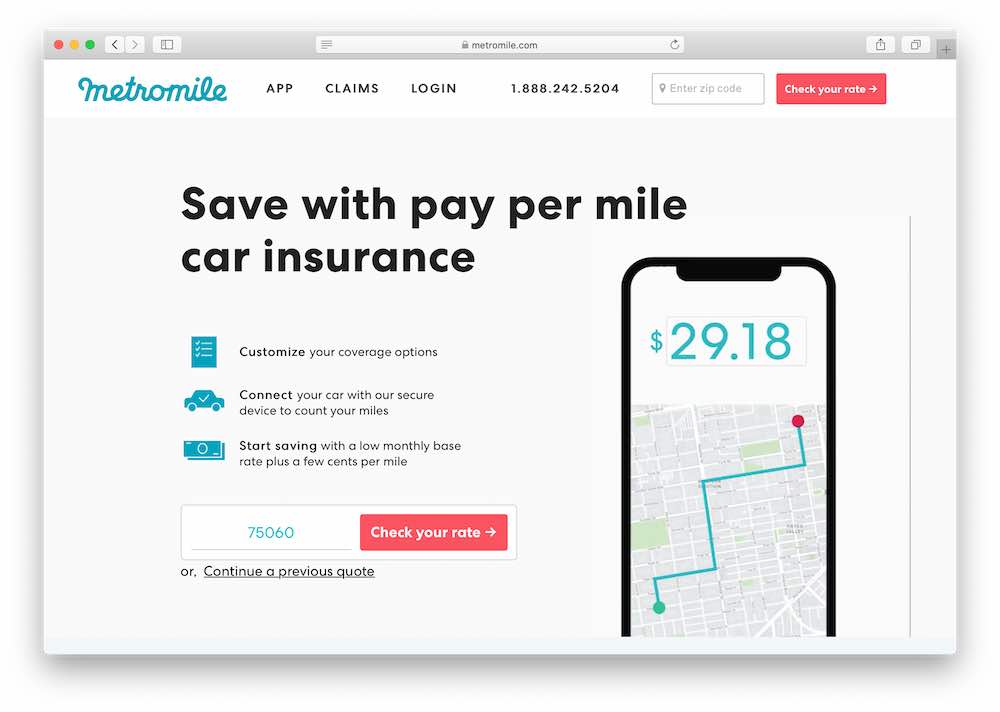

1. Metromile

The first provider on our list is MetroMile, an insurance provider that boasts of pay-per-mile insurance. This means your insurance is priced by how much you drive. The best part is any miles you rack up over the daily limit of 250 is free! Unfortunately, for New Jerseyans, the limit is 150 miles. But when you don’t drive, you are not charged.

This model allows MetroMile clients to save up to 47% in insurance costs over the span of a year compared to other auto insurance providers. If you’re not sure what your estimated price could be, MetroMile can give you a free quote with their Ride Along feature.

Ride Along requires you to download their mobile app for 17 days. During this timeframe you will drive how you normally would and the app will analyze your driving habits through your smartphone sensors. How much you pay is in your control. At the end of the 17-day trial, the app will use all the data gathered to allow MetroMile to give you the best quote.

Once you have an estimate, how much you pay can be calculated based on a simple equation. You have the monthly rate, which can be as low as $29, plus the number of miles you drove and a few cents extra for each. The answer to the equation could translate up to $741 saved per year!

MetroMile offers various coverage plans ranging from collision coverage, which includes accidents with other vehicles, fixed objects and more, along with a more comprehensive option that even covers natural factors such as weather-related damages.

It doesn’t matter what you need, MetroMile can accommodate you. When you become a part of the MetroMile family, you also get access to perks such as roadside assistance, glass repair and 24/7 claims services.

The MetroMile app is a consolidated platform that gives users the ability to file claims easily and even monitor your car’s condition and traffic. MetroMile is widely available across the nation and can be found in most states.

Pros

- Pay-per-mile insurance

- Easy claim filing

- Roadside assistance and other perks

- Easy MetroMile app

- Widely available

- Various coverages

- Lots of money saved

- Miles over the 250 daily limit are free

Why We Like It

MetroMile is a provider that does not overcharge. Instead, they tailor the plan according to how much you drive and give you free coverage on miles over the 250 daily limit.

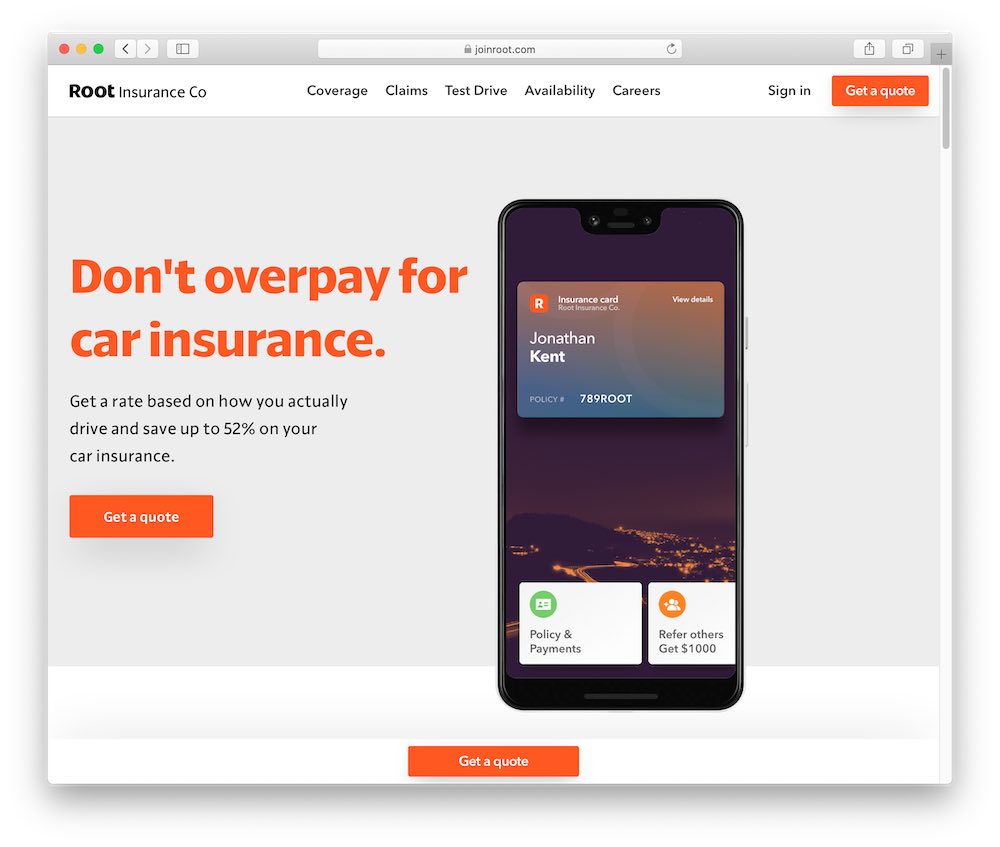

2. Root Insurance

If MetroMile doesn’t have you convinced, then we’re pretty sure Root Insurance will. If we could think of a few words to describe this provider, it would be: honest, fair and simple.

Root Insurance does its best to provide their customers with everything they could need at affordable prices. However, if you are able to find a better deal elsewhere, Root will put your interests first and not stand in your way of saving even more.

Their interface and claims filing is so simple and easy it won’t take you more than three minutes! If you do run into any issues, their customer support and claims staff are always at the ready.

Now we in simple terms why Root is honest and simple, but how are they fair? Root prides themselves in offering better insurance rates to good drivers. They take into account a driver’s habits on the road that include smooth breaking, focused driving, and even the time of day you drive the most. All of this data gets taken into consideration when Root analyzes the best price for your insurance.

It sounds like a difficult process, but all you need to do is download there app, drive around normally for a few weeks, and you could end up saving up to $900/year!

It doesn’t matter how good a driver you are, many accidents happen due to elements outside of our control. Rest assured in knowing that when these unfortunate events happen, the claims support is behind you.

Simply click into the Root app, and enter the type of accident or claim you want to file, take a picture of the damage and the customer support will take care of the rest. Root Insurance does a great job putting customers’ minds at ease by updating you every step of the way during your claim so you can pave peace of mind, knowing they are doing everything possible to assist you.

Root offers a variety of coverages just like most other providers such as liability, medical and car. If you want all of the above, you can select the combination package or full-coverage package that protects you against all three.

Root is slowly becoming a trusted nation-wide entity for premium car insurance. Their protection doesn’t stop there, because they also offer renters and homeowners insurance.

As a company featured on premier media publications such as The Wall Street Journal, CNBC, Forbes, Wired and more, Root has established itself as a trusted auto insurance provider that puts their customers first.

Pros

- Featured on leading media publications

- Gives perks such as free Lyft credits

- Almost nation-wide

- Various coverage plans

- Pricing based on driving habits

- Easy claim filing

- Has a compatible app

- Put customers’ interests first

Why We Like It

Even if they didn’t earn features on such prominent publications, Root Insurance earns our vote because they prove time and time again that your interests are what they care about.

How to Lower Insurance Premiums

As we mentioned, there are things you can do on your end to help lower the insurance premiums on your Bolt EUV.

Other than being as good a driver as you can be, investing in a defensive driving course to help you maneuver hazards on the road and protect yourself. Not all insurance companies will recognize a discount, so be sure to inquire before signing up for a class.

Installing safety devices on your Bolt EUV can also help save costs. For example, an anti-theft device or car alarms can make your car much more insurable. You can also think about increasing your deductibles as this will lower the overall monthly costs. However, this may not always make sense mathematically so make sure you do your calculations first.

The model and size of your EV can also influence the pricing. Some brands may cost more to insure such as certain Tesla models, but ones like the Nissan Leaf are cost-effective.

Conclusion

An EV is a pricey investment, so shopping around for the best auto insurance for your Bolt EUV is a must. This promises that your car is protected when accidents happen, and even covers your losses when it comes to theft. Looking for the right insurance provider can be time-consuming, but both Root and MetroMile are excellent options.